Shares of Take-Two Interactive Software, Inc. (NASDAQ: TTWO) soared 14% on Friday. The company delivered mixed results for the third quarter of 2025, as revenue came below estimates while loss per share was narrower than expected. It also revised its outlook for fiscal year 2025 and now expects a narrower loss per share for the period.

Q3 numbers

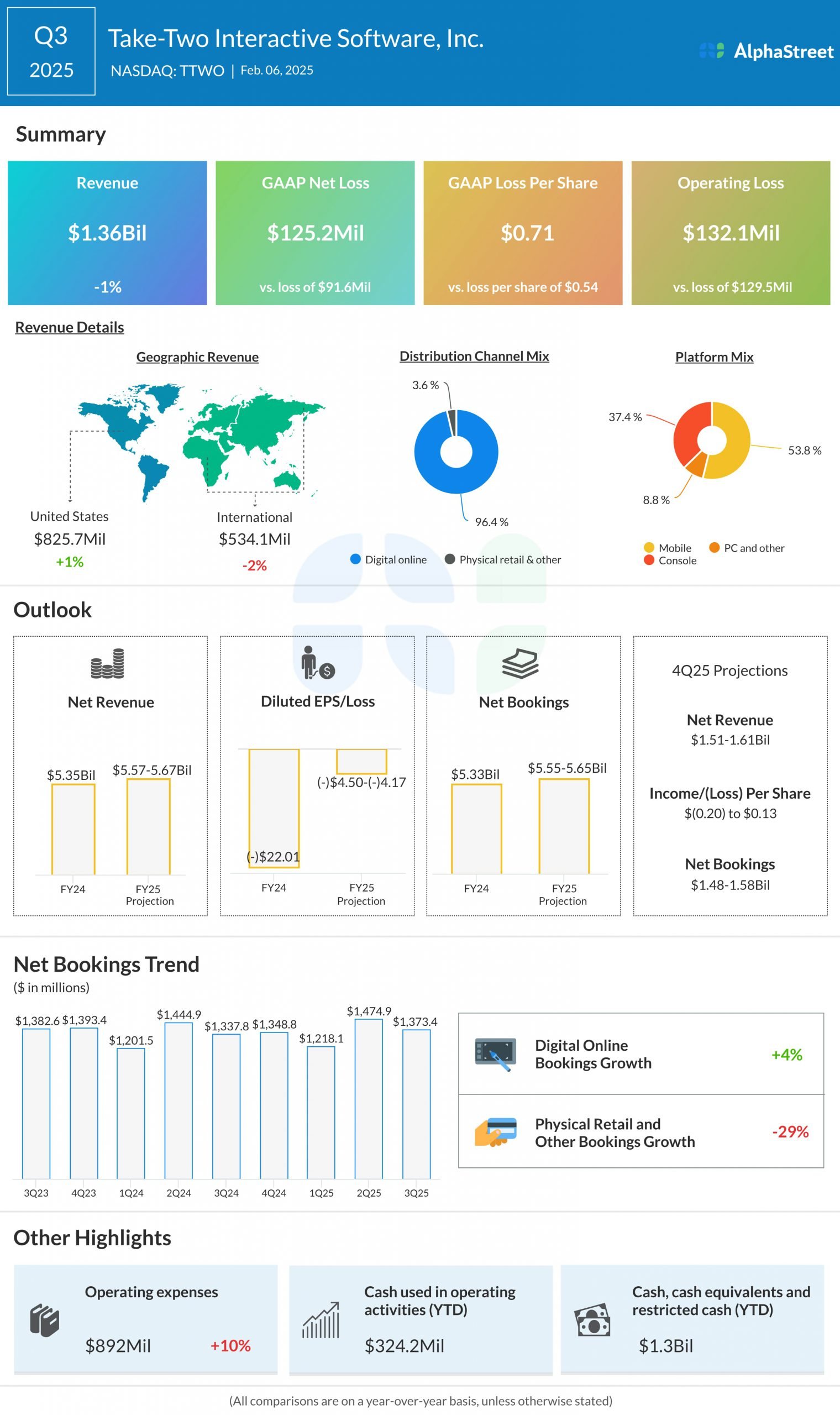

Take-Two’s net revenue dropped slightly to $1.36 billion in Q3 2025 from $1.37 billion in the same period a year ago, and fell short of estimates. Net loss per share was $0.71 versus $0.54 last year, but was narrower than the consensus target.

Business performance

In Q3 2025, net bookings grew 3% year-over-year to $1.37 billion. Recurrent consumer spending, which includes virtual currency, add-on content, and in-game purchases, increased 5%. Net bookings from recurrent consumer spending grew 9%. Net bookings were mainly driven by NBA 2K25, the Grand Theft Auto and Red Dead Redemption franchises, and mobile titles from Zynga.

The robust performance of NBA 2K helped offset softness in some of the company’s mobile franchises during the third quarter. TTWO anticipates strength in NBA 2K and softness in mobile to continue during the fourth quarter of 2025.

NBA 2K25 delivered a strong performance in Q3 2025. To-date, the title has sold-in over 7 million units. It saw a growth of over 30% in recurrent consumer spending along with a growth of nearly 20% in daily active users and nearly 10% in monthly active users.

Recurrent consumer spending in mobile increased mid-single-digits. While Toon Blast, Toy Blast and Match Factory delivered gains during the quarter, Empires & Puzzles performed below expectations. Although the performance of mobile was lower than expected, TTWO remains optimistic about Zynga’s pipeline of new titles.

Outlook

For fiscal year 2025, Take-Two expects net revenue of $5.57-5.67 billion. It revised its outlook for loss per share to a range of $4.50 to $4.17 from the previous range of $4.80 to $4.43. Net bookings are expected to be $5.55-5.65 billion, representing a YoY growth of 5%. Recurrent consumer spending is projected to grow 5%, with a low-double-digit growth in NBA 2K and a low-single-digit growth in mobile.

For the fourth quarter of 2025, revenue is expected to be $1.52-1.62 billion and net bookings is expected to be $1.48-1.58 billion. Recurrent consumer spending is expected to increase by approx. 3%, with a high-teens percentage increase for NBA 2K, partly offset by declines in mobile and GTA Online.

The post Take-Two (TTWO) expects strength in NBA 2K and softness in mobile to continue in 4Q25 first appeared on AlphaStreet.

Shares of Take-Two Interactive Software, Inc. (NASDAQ: TTWO) soared 14% on Friday. The company delivered mixed results for the third quarter of 2025, as revenue came below estimates while loss

The post Take-Two (TTWO) expects strength in NBA 2K and softness in mobile to continue in 4Q25 first appeared on AlphaStreet.

Categories Analysis, Leisure & Entertainment

Take-Two (TTWO) expects strength in NBA 2K and softness in mobile to continue in 4Q25

For the fourth quarter of 2025, revenue is expected to be $1.52-1.62 billion

Shares of Take-Two Interactive Software, Inc. (NASDAQ: TTWO) soared 14% on Friday. The company delivered mixed results for the third quarter of 2025, as revenue came below estimates while loss per share was narrower than expected. It also revised its outlook for fiscal year 2025 and now expects a narrower loss per share for the period.

Q3 numbers

Take-Two’s net revenue dropped slightly to $1.36 billion in Q3 2025 from $1.37 billion in the same period a year ago, and fell short of estimates. Net loss per share was $0.71 versus $0.54 last year, but was narrower than the consensus target.

Business performance

In Q3 2025, net bookings grew 3% year-over-year to $1.37 billion. Recurrent consumer spending, which includes virtual currency, add-on content, and in-game purchases, increased 5%. Net bookings from recurrent consumer spending grew 9%. Net bookings were mainly driven by NBA 2K25, the Grand Theft Auto and Red Dead Redemption franchises, and mobile titles from Zynga.

The robust performance of NBA 2K helped offset softness in some of the company’s mobile franchises during the third quarter. TTWO anticipates strength in NBA 2K and softness in mobile to continue during the fourth quarter of 2025.

NBA 2K25 delivered a strong performance in Q3 2025. To-date, the title has sold-in over 7 million units. It saw a growth of over 30% in recurrent consumer spending along with a growth of nearly 20% in daily active users and nearly 10% in monthly active users.

Recurrent consumer spending in mobile increased mid-single-digits. While Toon Blast, Toy Blast and Match Factory delivered gains during the quarter, Empires & Puzzles performed below expectations. Although the performance of mobile was lower than expected, TTWO remains optimistic about Zynga’s pipeline of new titles.

Outlook

For fiscal year 2025, Take-Two expects net revenue of $5.57-5.67 billion. It revised its outlook for loss per share to a range of $4.50 to $4.17 from the previous range of $4.80 to $4.43. Net bookings are expected to be $5.55-5.65 billion, representing a YoY growth of 5%. Recurrent consumer spending is projected to grow 5%, with a low-double-digit growth in NBA 2K and a low-single-digit growth in mobile.

For the fourth quarter of 2025, revenue is expected to be $1.52-1.62 billion and net bookings is expected to be $1.48-1.58 billion. Recurrent consumer spending is expected to increase by approx. 3%, with a high-teens percentage increase for NBA 2K, partly offset by declines in mobile and GTA Online.

Listen to the conference calls as they happen. Don’t miss a beat! With AlphaStreet Intelligence, you can listen to live calls and interviews as they happen, so you never have to worry about missing out on important information.

Most Popular

Infographic: Amazon (AMZN) Q4 2024 earnings beat estimates; sales rise 10%

E-commerce giant Amazon.com Inc. (NASDAQ: AMZN) on Thursday reported higher sales and profit for the fourth quarter of 2024. Earnings also beat analysts’ estimates. Net sales increased to $187.8 billion

Philip Morris (PM) delivers strong performance in 4Q24 helped by smoke-free strength

Shares of Philip Morris International Inc. (NYSE: PM) jumped 10% on Thursday after the company delivered better-than-expected earnings results for the fourth quarter of 2024 and provided an encouraging outlook

Highlights of Bristol-Myers Squibb’s Q4 2024 earnings report

Biotechnology company Bristol Myers Squibb (NYSE: BMY) reported lower profit for the fourth quarter of 2024, despite an increase in revenue. Net income attributable to shareholders was $72 million or

Tags

Discover more from World Byte News

Subscribe to get the latest posts sent to your email.